COMPLETED

CASE STUDY #1

- Land acquisition loan

- Developer in Subiaco, WA

- GVR = $1,850,000

INVESTMENT DETAILS

Rate

9.00% per annum

9.00% per annum

Term

Tailored to project timelines

Tailored to project timelines

COMPLETED

CASE STUDY #2

- Construction loan – daycare centre

- Developer in Dardanup, WA

- GVR = $2,500,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

Tailored to project timelines

Tailored to project timelines

COMPLETED

CASE STUDY #3

- Construction loan – 8 townhouses

- Developer in Nedlands, WA

- GVR = $18,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

Tailored to build schedule

Tailored to build schedule

COMPLETED

CASE STUDY #4

- Construction loan – 8 townhouses

- Developer in Kensington, WA

- GVR = $16,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

Milestone-based

Milestone-based

COMPLETED

CASE STUDY #5

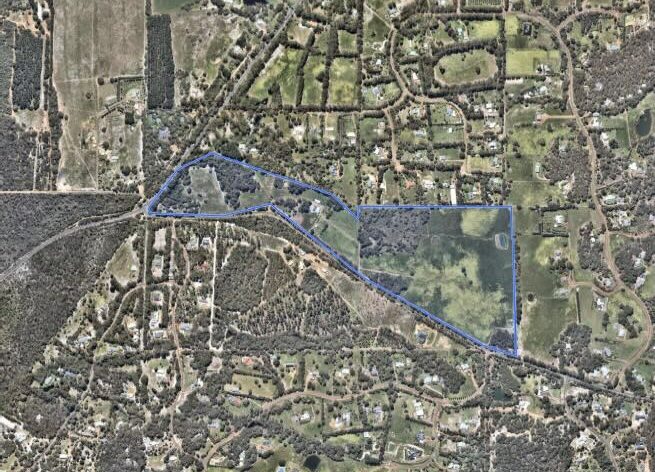

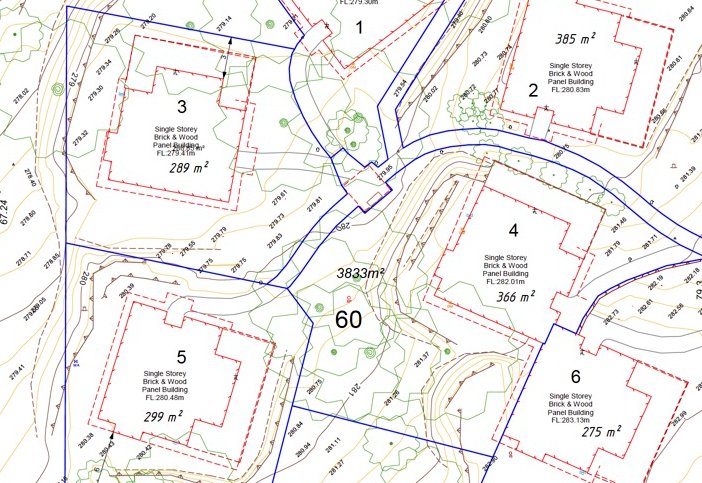

- Land acquisition & subdivision loan

- Developer in Quedjinup, WA

- GVR = $20,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

Milestone-based

Milestone-based

COMPLETED

CASE STUDY #6

- Land acquisition & subdivision loan

- Developer in Huntingdale, WA

- GVR = $12,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

Milestone-based

Milestone-based

COMPLETED

CASE STUDY #7

- Land subdivision loan

- Developer in Huntingdale, WA

- GVR = $15,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

Milestone-based

Milestone-based

COMPLETED

CASE STUDY #8

- Construction loan – 2 townhouses

- Developer in Mosman Park, WA

- GVR: $5,750,000

INVESTMENT DETAILS

Rate

9.95 per annum

9.95 per annum

Term

Progressively drawn

Progressively drawn

COMPLETED

CASE STUDY #9

- Land acquisition and subdivision funding

- Located in Southern River

- GVR = $15,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #10

- Refinance of existing private loan to better terms

- Located in South Perth

- GVR = $11,500,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

1 year

1 year

COMPLETED

CASE STUDY #11

- Construction of 6 townhouses

- Located in Mount Pleasant, WA

- GVR = $24,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #12

- Purchase of residential house in a company name

- Located in Dalkeith, WA

- GVR = $7,000,000

INVESTMENT DETAILS

Rate

8.00% per annum

8.00% per annum

Term

3 years

3 years

COMPLETED

CASE STUDY #13

- Land subdivision (no presales)

- Location = Mundaring

- GVR = $5,000,000

INVESTMENT DETAILS

Rate

8.00% per annum

8.00% per annum

Term

1 year

1 year

COMPLETED

CASE STUDY #14

- Construction loan on rural property

- Located in Cataby, WA

- GVR = $5,640,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

3 years

3 years

COMPLETED

CASE STUDY #15

- Land sub division of 23 lots

- Located in Hamilton Hill, Western Australia

- GVR = $11,850,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #16

- Land acquisition

- Subdivision site located in Darch

- GVR = $76,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #17

- Development site

- Located in Southern River, Western Australia

- GVR = $7,500,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #18

- Private loan

- Property purchase in Carabooda area

- GVR = $9,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #19

- Recent transaction in Bullsbrook

- Refinance existing loan from another private lender to a better rate

- GVR = $18,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #20

- Recent transaction settled in Perth’s western suburbs

- Private purchase of high-end property

- GVR = $10,500,000

INVESTMENT DETAILS

Rate

8.00% per annum

8.00% per annum

Term

1 year

1 year

COMPLETED

CASE STUDY #21

- Private construction loan

- $11.8m development site in Southern River

- GVR = $22,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #22

- Private construction loan

- $22m development site in Manning

- GVR = $22,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #23

- Day Care Centre in Wellard

- GVR = $3,250,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #24

- Recent Transaction in South Perth

- GVR = $28,000,000

- Purpose = Construction loan for 38 apartments

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #25

- 12 Unit Development Loan in Como, Perth (With Only 1 Presale)

- GVR = $12,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #26

- Recent Transaction Settled in Cottesloe, WA

- GVR = $2,000,000

- Loan purpose = Funds for business use

INVESTMENT DETAILS

Rate

8.00% per annum

8.00% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #27

- Albany, WA

- Limestone mine

- GVR = $3,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years

COMPLETED

CASE STUDY #28

- West Perth, WA

- Residential property development

- GVR = $8,000,000

INVESTMENT DETAILS

Rate

8.00% per annum

8.00% per annum

Term

12 months

12 months

COMPLETED

CASE STUDY #29

- Perth, WA

- For land subdivision

- GVR = $7,000,000

INVESTMENT DETAILS

Rate

8.00% per annum

8.00% per annum

Term

18 months

18 months

COMPLETED

CASE STUDY #30

- Shark Bay, WA

- For land subdivision

- GVR = $10,000,000

INVESTMENT DETAILS

Rate

9.95% per annum

9.95% per annum

Term

2 years

2 years